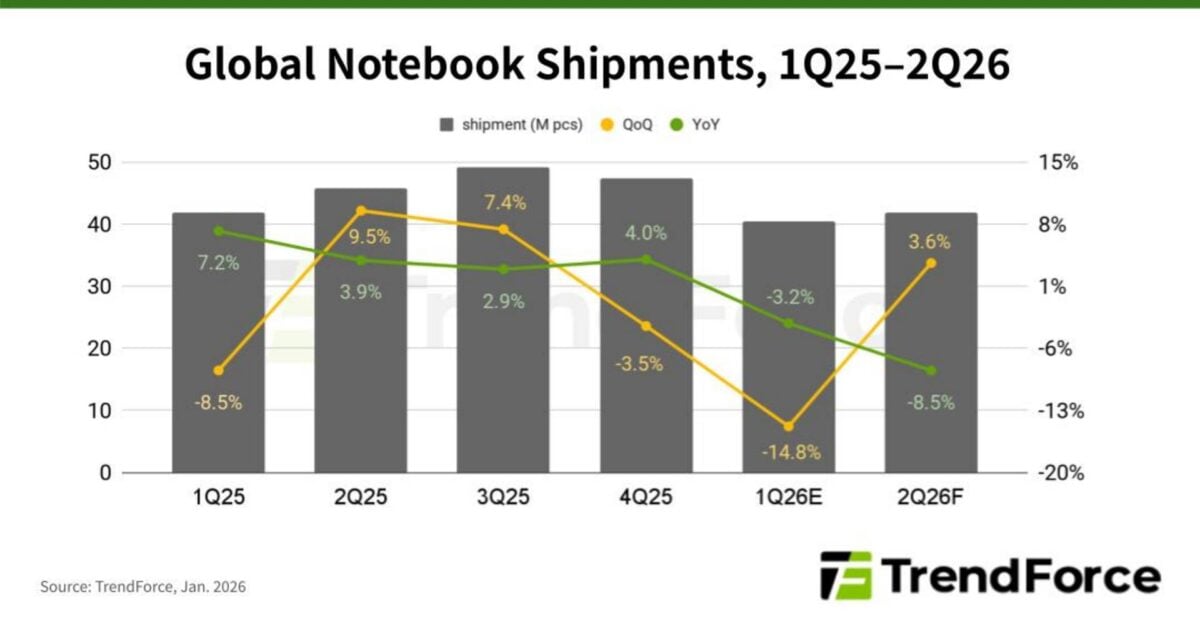

Global notebook shipments are suffering from the ongoing memory shortages, as demand dwindles due to increased device prices. Going into 2026, this situation is expected to worsen as CPUs enter a supply shortfall too. Q2 2026 could see a slight improvement, but the overall trend remains negative, says TrendForce.

According to the latest survey of the notebook industry, global device shipments are forecasted to go down by 9.4% year-over-year (YoY) and 14.8% quarter-to-quarter (QoQ) due to supply constraints and unclear brand strategies. This new estimation is lower than the brand’s initial expectations, as unusual storage, CPU, and even PCB costs enter the equation.

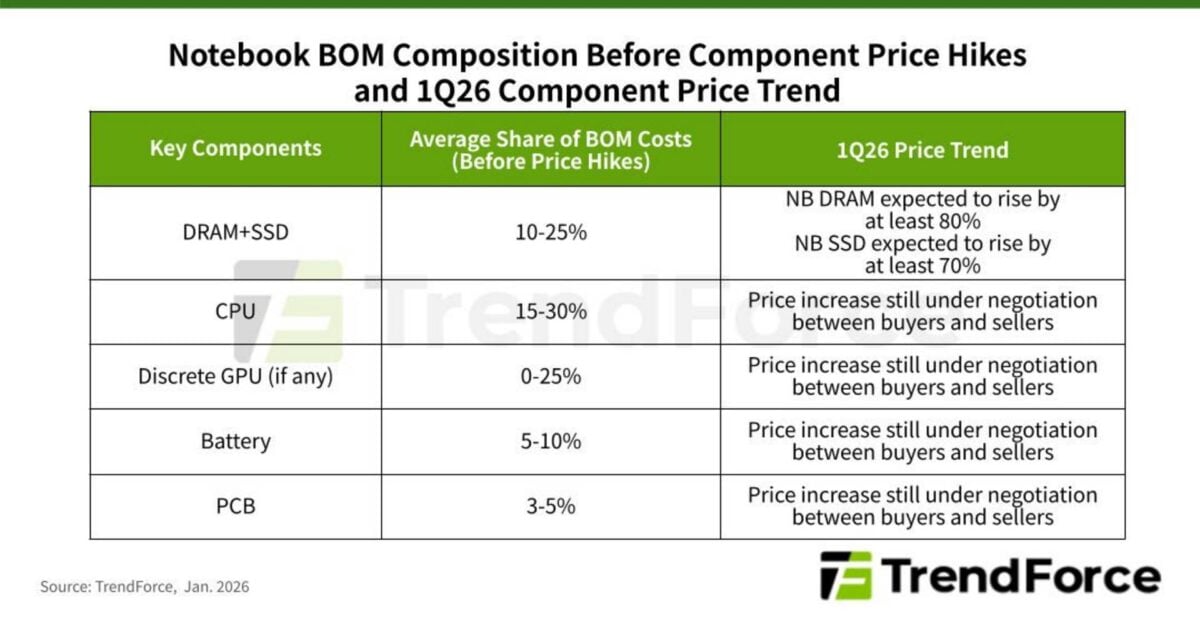

TrendForce indicates that about 15 to 30% of the device’s total BOM (Bill of Materials) is taken by the CPU, followed by the GPU at 25%, 10 to 25% for the RAM + SSD, 5 to 10% for the battery, and 3 to 5% for the PCB. Considering that most entry-level laptops are powered by Intel processors, the latter’s recent price hike – compounded by a reduced supply – is adding pressure while causing shipment delays. This situation is expected to persist until after March.

The RAM and SSD prices are also to blame for this situation, as previous forecasts have been significantly exceeded, marking over 80% and 70% QoQ increase, respectively. This is not surprising considering the unusually high demand from AI datacentres, which encouraged memory producers to focus on high-bandwidth memory (HBM) manufacturing instead of standard memory for general PCs and notebooks. And as if this wasn’t enough, some device manufacturers went on an aggressive purchase spree to secure their share, which further reduced memory inventories, driving prices up.

Because of this, industry forecasts indicate that DRAM and SSD contract prices are likely to stay high throughout at least the first half of 2026, potentially rising further with no relief until late 2026 or 2027 as new production capacity kicks in.

But that’s not all, PCBs are also driving these costs up, both due to the increased design complexities required to handle faster hardware signalling and the simple surge in copper prices. The latter marked record highs in early 2026, with 1-year gains exceeding 40%. Add to that the lithium required for batteries, which doubled in price in just a couple of months, and the overall TrendForce forecasts seem optimistic.

According to TrendForce, brands might face difficulties in securing all necessary components on time, leading to a projected 14.8% QoQ decline in Q1 2026 shipments. That said, a mild QoQ rebound is expected in Q2 2026 as Intel’s CPU supply improves. Even so, the forecast will remain negative YoY. This could force OEMs to downgrade some system specifications to maintain a higher unit production, perhaps focusing on mid- to low-end products that don’t require a lot of RAM and SSD capacities.

Due to all of the above, TrendForce has lowered its forecast for notebook shipments from a 5.4% YoY decline to a more significant 9.4% decrease. Adding that, moving forward, product strategies and consumer acceptance of higher prices will shape the second half of 2026.