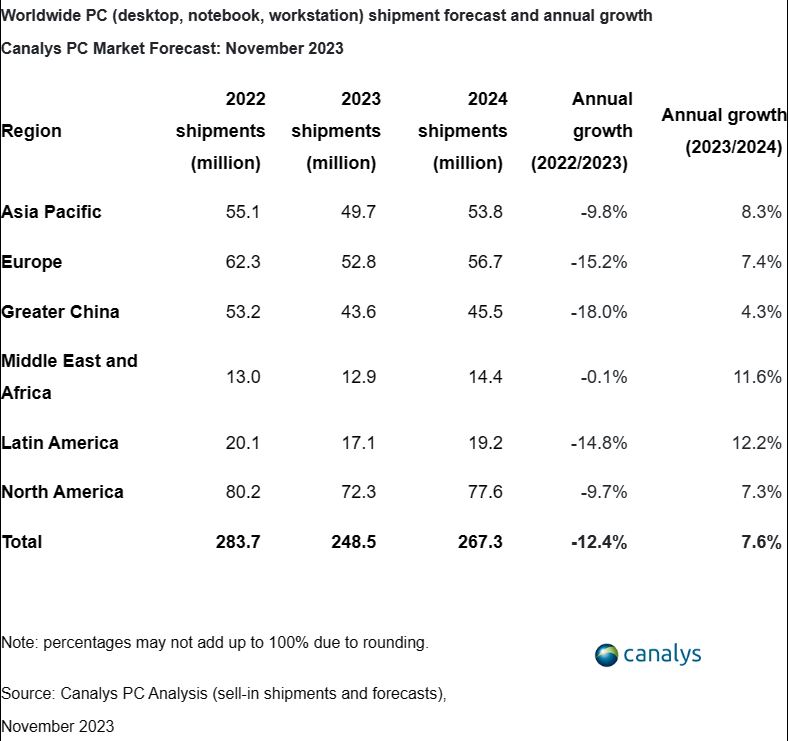

Market research firm Canalys believes the PC market is putting its best foot forward in 2024 and forecasts worldwide shipments to increase by 8% when compared to this year.

The optimistic figure comes by way of a research update dated November 30. Of particular note, Canalys indicates that “Looking ahead, full-year 2024 shipments are forecast to hit 267 million units, landing 8% higher than in 2023, helped by tailwinds including the Windows refresh cycle and emergence of AI-capable and Arm-based devices.”

It must be noted that 2023 was a particularly poor year for the PC industry. 2022 global shipments of 283.7 million dropped to merely 248.5 million. Part of this 12.4% decrease is explained by the fervent purchasing in the pandemic-fuelled work-from-home era, of course, but the trend is undeniable.

2024’s projected figures go some way in making up for the huge shortfall this year, though the number naturally remains below the 2022 watermark.

Digging down into territories, the Middle East and Latin America are the most fertile grounds for growth. Great China, meanwhile, took a hammering in 2023 by dropping 18% on 2022. There are cautious shoots of recovery in 2024, which is a trend replicated everywhere.

“Following a prolonged period of delayed purchasing, the commercial segment is poised for a demand bump in 2024,” said Canalys Principal Analyst Ishan Dutt. “Channel sentiment around PC business performance next year is positive, with 47% of partners polled in November anticipating their Windows PC shipments to grow 10% or more next year. SMBs have been highlighted as a strong opportunity, with the recent macroeconomic difficulties having had a proportionally larger impact on their ability to budget for PC procurement over the last several quarters. Next year will also bring a proliferation of Arm-based PCs, largely driven by Qualcomm’s X Elite chip. While uptake is initially likely to be restrained, particularly in commercial settings, the ability to deliver improvements in power efficiency and battery life will be a boon to offerings partners can bring to customers.”

I find it interesting Canalys puts great store in the ability of Arm-powered devices in turbocharging demand. The recently announced Qualcomm Snapdragon X Elite sure looks potent on paper, but as I’ve seen on numerous occasions before, translating specifications to hard sales is a different matter altogether.

Nevertheless, any supposed upturn is a good thing for the industry as a whole, indicating a more positive sentiment, especially for small to medium businesses looking to update their ageing hardware.

![Should you play Hades 2 in early access? Nemesis asks: Are you about ready to give in [to buying Hades 2 in early access]?](https://www.club386.com/wp-content/uploads/2024/05/Should-I-play-Hades-2-in-early-access-218x150.jpg)